Participants in Optionsġ.Buyer of an Option – The one who by paying the premium, buys the right to exercise his option on the seller/writer.Ģ. The regulator has also authorized the American style of settlement for such options. The contract gives the holder the right to buy or sell the underlying shares at the specified price. These are options on the individual stocks (with stock as the underlying). Examples of such options include Nifty options, Bank Nifty options, etc. In India, the regulators authorized the European style of settlement. These are the options that have an index as the underlying. Options can be used to hedge, take a view on the future direction of the market, for arbitrage, or for implementing strategies that could help in generating income for traders. These instruments provide settlement guaranteed by the clearing corporation, thereby reducing counterparty risk. Utility of the Exchange-Traded OptionsĮxchange-traded options constitute an important class of options that have standardized contract features and trade on public exchanges, facilitating the investors.

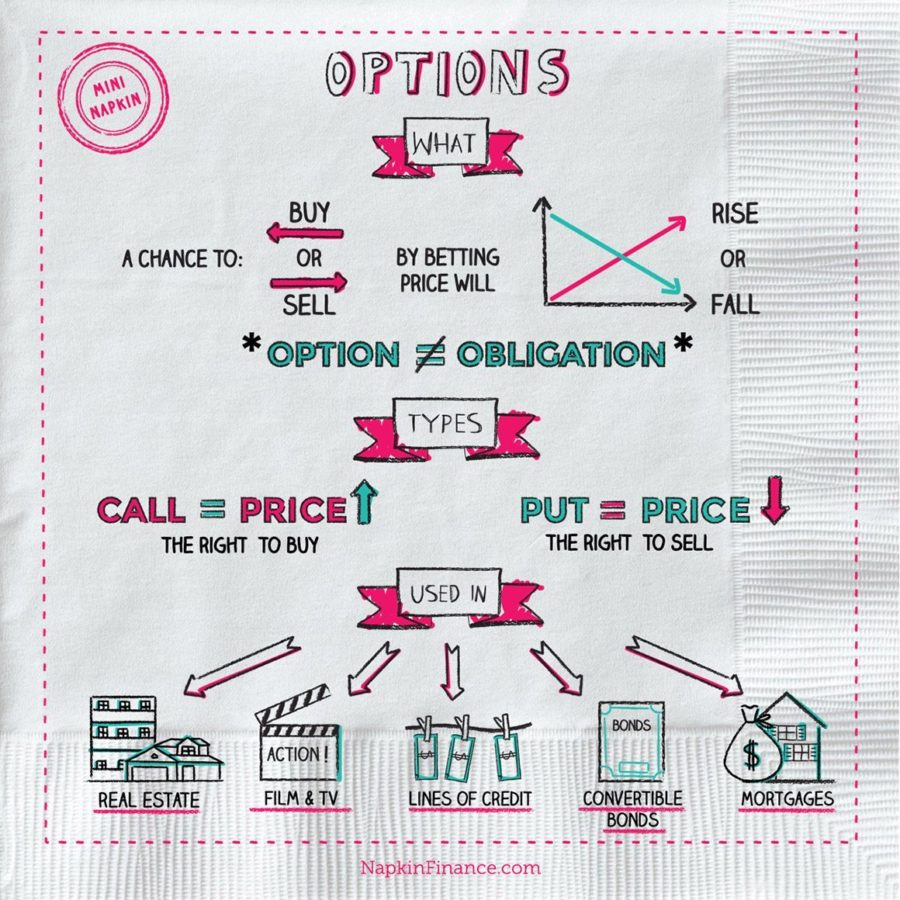

In return for granting the option, the seller collects a payment (known as a premium) from the buyer. Exercise the right to buy or sell at the strike price prior to the option’s expiration date.An option is a contract that is written by a seller that conveys to the buyer the right - but not an obligation to buy (for a call option) or to sell (for a put option) a particular asset, at a specific price (strike price/exercise price) in future.Buy or sell to “close” the position prior to expiration.In return for the premium, assumes the obligation to purchase the underlying investment from the put buyer at the strike priceĪn options contract can be cashed out in one of three ways: In return for the premium, assumes the obligation to sell the underlying investment to the call buyer at the strike price Pays a premium for the right to sell the underlying investment to the put seller at the strike price Pays a premium for the right to purchase the underlying investment from the call seller at the strike price The strike price is the stated price per share for which the underlying stock may be purchased (in the case of a call) or sold (in the case of a put) by the option holder upon exercise of the option contract.īriefly, here are the positions an option trader can assume:

The seller, aka writer, on the other hand, assumes an obligation to either buy or sell (depending on the type of option involved) the underlying investment at the strike price if the buyer chooses to exercise the option. The buyer pays the seller a premium for the right to exercise the option at the strike price until the contract’s expiration date. There are two kinds of options - calls and puts - and a trader can be a buyer or seller of either. In other words, an option’s value will fluctuate in response to changes in the underlying investment’s price. Options are considered a derivative because their value is based on (derived from) the underlying investment’s price.

0 kommentar(er)

0 kommentar(er)